Prosperity Needs More Than Hustle—It Needs Financial Clarity

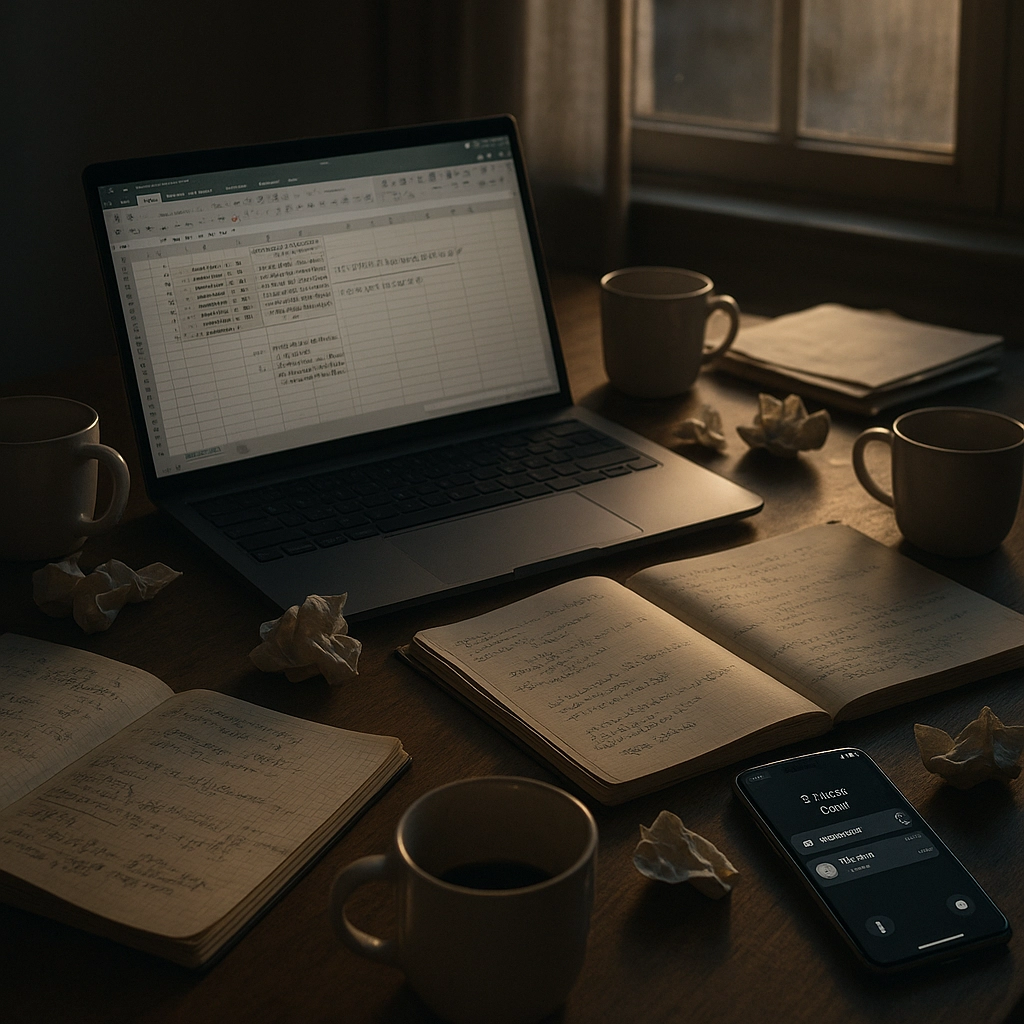

It's 2 AM. You're still awake, staring at endless rows of numbers that somehow don't add up. Your vision for this company was brilliant, transformative even. Yet here you are, drowning in formulas and pivot tables instead of leading your team toward that horizon.

Welcome to the spreadsheet hangover—that foggy, disorienting state where founders find themselves trapped between their visionary goals and the brutal reality of financial management.

At Executive Financial Partners, we've seen it countless times: brilliant entrepreneurs who can pitch their vision flawlessly but break into a cold sweat when it's time to analyze cash flow projections or explain their unit economics to investors.

Why Smart Founders Get Stuck in Spreadsheet Purgatory

The path from innovative idea to sustainable business is paved with numbers. Yet most founders didn't launch their companies because they love financial modeling. They launched because they spotted an opportunity, developed a solution, or wanted to change an industry forever.

Here's why the numbers game creates such a painful hangover:

1. You're Building the Financial Plane While Flying It

Most startups begin with scrappy financial systems—a combination of basic accounting software, spreadsheets, and maybe invoicing tools cobbled together as needs arise. This approach works in the earliest days but quickly becomes unwieldy as you scale.

"I started with tracking everything on paper, graduated to spreadsheets, then realized I was spending 15 hours weekly just managing data," shares one founder who later became an EFP client. "I was making decisions based on intuition because my numbers were always weeks behind reality."

2. You're Speaking a Second Language

For non-financial founders, accounting terminology and financial concepts often feel like a foreign language—one you're expected to speak fluently when communicating with investors, lenders, or financial partners.

When founders can't confidently translate between their operational understanding and financial outcomes, they often retreat to their spreadsheets, endlessly tweaking and second-guessing rather than making decisive moves.

3. Your Data Lives in Silos

Sales data in one system. Expenses in another. Inventory somewhere else. Customer acquisition costs calculated manually in yet another spreadsheet.

This fragmentation creates a perfect storm: numbers that never reconcile, metrics that can't be trusted, and a persistent feeling that you're missing something important—because you probably are.

The Hidden Costs of Spreadsheet Dependency

The spreadsheet hangover costs far more than just late nights and frustration:

Opportunity Costs

Every hour spent reconciling numbers or fixing formula errors is an hour not spent on strategy, team development, or customer relationships. For founders, time is the scarcest resource—and spreadsheet troubleshooting is rarely the highest-value use of that time.

Decision Paralysis

When you don't fully trust your numbers, making confident decisions becomes nearly impossible. We've seen founders delay critical hiring, miss expansion opportunities, or hold back on necessary investments simply because they couldn't validate the financial impact with confidence.

Funding Roadblocks

Investors expect founders to know their numbers cold—not just revenue and growth rates, but contribution margins, customer acquisition costs, lifetime value metrics, and cash runway calculations. Spreadsheet-dependent founders often struggle to produce consistent, accurate metrics, creating credibility gaps with potential funders.

The Burnout Factor

The psychological toll of persistent financial uncertainty shouldn't be underestimated. The constant low-grade anxiety of "not quite knowing" creates a cognitive load that depletes creativity and resilience—the very qualities entrepreneurs need most.

Breaking the Cycle: The Path From Spreadsheet Chaos to Financial Clarity

The good news? Spreadsheet hangovers are curable. At Executive Financial Partners, we've guided countless founders through this transition using our proven process: Diagnose, Determine, Develop, Execute, Optimize.

1. Diagnose: Know Where You Stand

The first step is getting brutally honest about your current financial systems and knowledge gaps. This isn't about assigning blame—it's about creating a baseline for improvement.

Start by asking:

- What financial decisions cause you the most stress?

- Which metrics do you track regularly, and which do you avoid?

- How much time do you and your team spend on financial data entry, reconciliation, and reporting?

- When was the last time you made a major decision with complete financial confidence?

2. Determine: Design Your Financial Architecture

Once you understand the gaps, you can design a financial system that actually serves your business needs rather than creating additional work.

Effective financial architecture includes:

- Streamlined accounting processes that deliver timely, accurate data

- Integrated systems that eliminate duplicate data entry

- Clear financial metrics tied directly to operational activities

- Reporting cadences that match your decision-making needs

3. Develop: Build Financial Fluency

No founder needs to become a CPA or financial analyst, but developing basic financial fluency transforms your relationship with your numbers.

"Understanding the story behind the numbers changed everything," says a technology founder who worked with EFP. "I went from dreading financial reviews to using them as my strategic compass. The difference wasn't the numbers themselves—it was my ability to interpret them."

At Executive Financial Partners, we believe financial literacy is a founder superpower. Our clients learn to translate between business operations and financial outcomes, creating a virtuous cycle where better understanding leads to better decisions, which create better results.

4. Execute: Implement Systems That Scale

The right financial systems grow with your business rather than requiring constant reinvention. Whether you need cloud accounting solutions or fractional CFO expertise, implementation should focus on creating sustainable processes, not just quick fixes.

Effective execution includes:

- Selecting the right financial tools for your industry and stage

- Creating clear roles and responsibilities for financial management

- Establishing rhythms for financial review and planning

- Building dashboards that highlight what matters most

5. Optimize: Continuous Improvement

Financial excellence isn't a destination—it's a journey of continuous refinement. As your business evolves, your financial needs will change. The founders who thrive are those who view their financial systems as living tools rather than fixed solutions.

Real Recovery: How One Founder Escaped Spreadsheet Hell

Alex (name changed) came to EFP after losing a major investor—not because the business wasn't promising, but because Alex couldn't confidently answer basic questions about unit economics during due diligence.

"I had the data somewhere in my seventeen interconnected spreadsheets," Alex recalled. "But I couldn't pull it together quickly, and when I finally did, I realized some of my calculations were fundamentally flawed. The investor walked, and I was devastated."

Working with our fractional CFO service, Alex:

- Implemented integrated financial systems that eliminated duplicate data entry

- Created dashboard reporting that highlighted the metrics investors cared about most

- Developed a financial forecast model that connected operational decisions to financial outcomes

- Built a cash management system that prevented surprises and extended runway

Six months later, Alex secured funding from two investors who had previously passed. The difference? "I knew my numbers cold. I could show exactly how we'd use the capital and what return it would generate. But more importantly, I finally had the bandwidth to be the visionary my company needed because I wasn't spending every night drowning in spreadsheets."

The Morning After: Life Beyond the Spreadsheet Hangover

Founders who overcome spreadsheet dependency discover something surprising: financial clarity becomes a competitive advantage, not just an administrative necessity.

When you trust your numbers, you can:

- Make faster decisions with greater confidence

- Identify problems before they become crises

- Allocate resources more strategically

- Focus your creative energy on growth rather than survival

- Sleep through the night without financial anxiety

Ready for Relief?

If you're tired of spreadsheet hangovers, it's time for a different approach. At Executive Financial Partners, we specialize in helping visionary founders develop the financial clarity they need to scale with confidence.

Whether you need process improvement, audit readiness, or strategic financial guidance through our fractional CFO services, our team brings both the technical expertise and entrepreneurial mindset you need.

Your vision deserves more than spreadsheet struggles. Connect with our Atlanta advisors today to discover how our signature process helps founders like you forecast with confidence and lead with clarity.

Because when your numbers work for you—not against you—there's nothing standing between you and your horizon.